Purpose

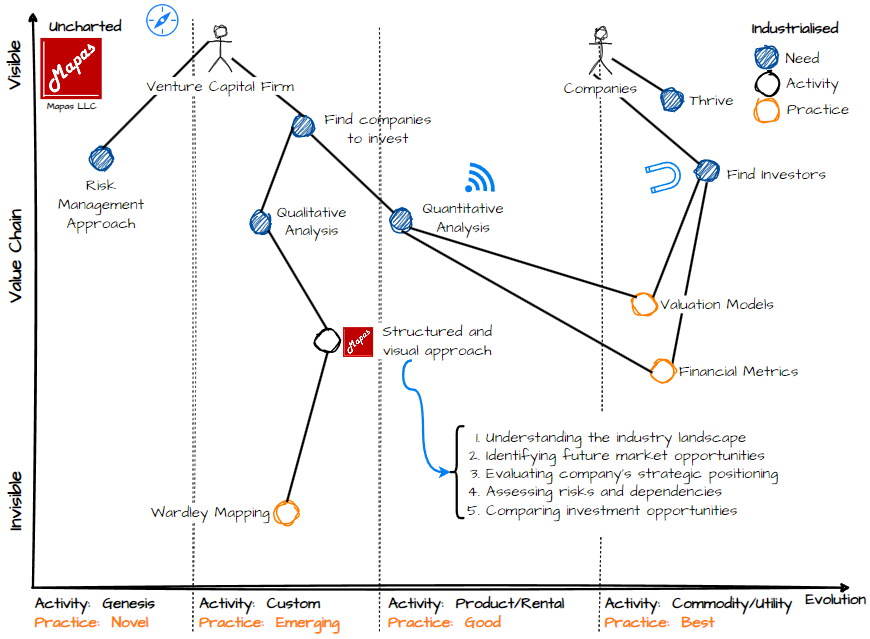

The purpose of this service is to provide a structured approach for Venture Capital firms about how to perform a better qualitative analysis of a potential investment.

Context

Venture Capital firms have their own processes to analyze industries and companies. They mainly are quantitative analysis based on valuation models and financial metrics. Qualitative analysis is something taken into account.

The problem?

- Depending on the type of industry and the type of company the qualitative analysis differ in how is done and how decisions are done.

- This implies that all people in the decision making process need to be familiar with all these type of manners of analyzing.

- When analyzing companies from a common industry there is no always clear way to compare on the same context. Here quantitative analysis help a lot, but is it enough?

Our proposition

For those companies that are willing to level up their qualitative analysis, we propose the use of Wardley Mapping with a concrete set of uses.

Learn Wardley Mapping give you the ability to use a common nomenclature and a set of visual support that help on the communications of scenarios and a better understanding when you are reading analysis of other colleagues.

Some of the concrete uses of Wardley Mapping are:

- Understanding the industry landscape

- Identifying future market opportunities

- Evaluating company’s strategic positioning

- Assessing risks and dependencies

- Comparing investment opportunities

For technology based companies we are able to perform a technology due diligence of the complete tech stack.

How we do it?

- First, we do a preliminary work to define scope, expectations and identify the stakeholders.

- A Kick-off meeting where the process itself is reviewed and the main participants understand and agree about how things are going to work.

- Revision of the documentation.

- Interviews with the identified stakeholders, with a walkthrough.

- Build the report and ask for final questions.

- Deliver the report.

Due diligence is a very contextual process

and by that reason the topics you cover can vary a lot. The basis for technical companies are:

- The market fit they have found or they are exploring

- The business model the company implements to take advantage of the context where they compete.

- The strategy they are using to advance in the environment where they work.

- The product side of the company.

- The leadership team.

- The development processes and the practices used.

- The infrastructure.

- The deployment process.

- The architecture of the solutions

- The quality assurance and testing processes

- How people work with other teams.

- How aligned they are to the compliance requirements of their context.

- Security.

- The horizontal processes (human resources, finance, marketing, etc)

- How decisions are done (for instance which technical components are build or consumed from other vendors).

Benefits

The proposed qualitative analysis approach have many benefits, the main ones are:

- Complete view of the context the business is competing with different perspectives.

- Understanding not only of the static view, but also the dynamics that are happening around the landscape.

- Deep dive in areas where you are interested to understand how things are being done.

When the firm get this qualitative analysis for the first time, the benefits are concrete to that space. But when they uses it several times, they build a better view of how to get the concrete context as ask better questions. Even experimented VC professional get surprised about how valuable this approach is.

Testimonials

- “I was exceptic about the proposed value, but when I look into the visual reports documented with specific information about assumptions, relative competition, risks, points of focus, etc.. I changed my view on the value” (VC Analyst).

- “We used this service to analyse some vendors and the information provided for each potential vendor gave us a good understanding about what was offered by each one, and made easier the decision about what vendor was the right one ” (member of Board of directors).

Contact me at: joaquin@mapasllc.com